National Aboriginal Capital Corporations Association (NACCA), the Government of Canada, the Business Development Bank of Canada (BDC), and other government partners increase access to capital with an innovative, evergreen fund, a first of its kind in Canada.

The Indigenous Growth Fund (IGF) is a new $150M investment fund that will provide access to the capital that Indigenous small- and medium-sized enterprises (SMEs) have long sought and lacked. Indigenous entrepreneurs across all industries, including emergent exporters and food and agriculture related businesses, will be able to access the Fund via business loans from a network of Aboriginal Financial Institutions (AFIs) throughout the country.

Lead investments in the IGF come from the Government of Canada and the Business Development Bank of Canada (BDC), with further commitments made by Export Development Canada (EDC) and Farm Credit Canada (FCC). The investments demonstrate a concrete commitment to economic reconciliation, and a crucial step on the path to prosperity for Indigenous peoples. The Fund’s model, which was structured by NACCA and BDC Capital, BDC’s investment arm, connects private investors to Indigenous businesses. The structure relies on AFIs’ ability to deploy capital based on their unique understanding of, and connection to, the communities they serve.

“The IGF is a demonstration of the type of work NACCA is capable of as a leading national Indigenous organization in Canada. This Fund is the product of decades of advocacy work by NACCA and demonstrates confidence in the developmental lending work that AFIs have been tirelessly doing,” states Jean Vincent, Chair of the Board of Directors for NACCA. “The demand of our entrepreneurs for more capital has mounted steadily; now AFIs will be in a position to meet it.” Since it was announced in Budget 2019, NACCA, working with BDC and the Government of Canada, has prioritized the development of the IGF.

“We are excited to see the IGF become a reality,” adds Michael Denham, President and CEO, BDC. “AFIs know Indigenous entrepreneurs better than anyone; they are close to the Indigenous communities and understand their needs. Alongside NACCA, we are providing through these AFIs financing for a growing number of Indigenous entrepreneurs, reaching into the remote and urban communities where financing is needed.”

About NACCA and the Aboriginal Financial Institution Network

The National Aboriginal Capital Corporations Association (NACCA) is the umbrella organization for a network of over 50 Aboriginal Financial Institutions (AFIs) across Canada. NACCA’s mandate is to serve, support and advocate for the Aboriginal Financial Institutions network.

Aboriginal Financial Institutions (AFIs) are autonomous, Indigenous controlled, community-based financial organizations. AFIs provide developmental loans and business financing to First Nations, Métis, and Inuit entrepreneurs and businesses in all provinces and territories.

AFIs are key drivers for the economic advancement of Indigenous peoples and prosperity of their communities. With nearly 50,000 loans worth close to $3 billion made over the past three decades, the AFI network continues to play a critical role, filling the financing gaps and unmet needs of Indigenous entrepreneurs. Beyond loans, clients can access additional supports such as non-repayable contributions, financial and management consulting, and business start-up/aftercare services.

Annually the AFI network makes $125M in new loans – but there is potential to lend out much more. In 2020, the network again showed its ability to move capital quickly to where it is most needed, as part of the federal government’s response to the COVID-19 crisis.

About BDC

BDC is the bank for Canadian entrepreneurs. It provides access to financing, as well as advisory services to help Canadian businesses grow and succeed. Its investment arm, BDC Capital, offers a wide range of risk capital solutions. For more than 75 years, BDC’s only purpose has been to support entrepreneurs in all industries and at all stages of growth. For more information and to consult more than 1,000 free tools, articles and entrepreneurs’ stories, visit bdc.ca.

FAQ

What is a “first close”?

The “first close” or “initial close” of a Fund is the first time that investors legally commit to making their investment. In the case of the IGF, the execution of a series of agreements on March 31, 2021 confirmed investments from the Government of Canada ($50M), BDC ($50M), EDC ($35M) and FCC ($15M).

When will the IGF be operational?

Work still needs to be done to operationalize the Fund and AFIs will be able to apply to the Fund in the coming months if they meet eligibility criteria. Once an AFI’s application has been assessed and approved based on commercial, risk and demand considerations, the AFI will be able to access the IGF and flow capital to Indigenous enterprises. An operational launch is anticipated later in 2021.

What else can you tell me about the structure of the Fund?

The Fund is structured to accept investments from Accredited Investors, such as:

- Public and Private Foundations

- Indigenous Trusts

- Corporate Canada

- Other Institutional investors

Please contact Frank Richter, frichter@nacca.ca, if you have further questions regarding investment.

The Fund is evergreen and new investors can be brought on an ongoing basis to grow the Fund or to replace capital from other investors who choose to redeem capital.

The Indigenous Growth Fund is a limited partnership with NACCA as the Fund Manager.

I’m an Indigenous Entrepreneur, how and when can I access the IGF?

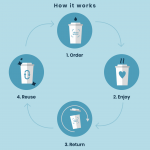

Loan capital from the IGF will flow through the network of AFIs to Indigenous businesses that are looking to start or expand. AFIs accept new loan inquiries on an ongoing basis. Indigenous businesses cannot access the IGF directly; however, starting later in 2021, an increasing number of AFIs will be able to provide more and larger loans to Indigenous enterprises drawing on capital from the IGF. A list of main offices of Aboriginal Financial Institutions across the country can be found here.